Through a compilation of industry standards, insights from stakeholders like nongovernmental organizations and suppliers, and our more than 25 years of experience with life cycle assessments (LCA), we identified the most significant environmental and social impacts of Ball's packaging products at each stage of their life.

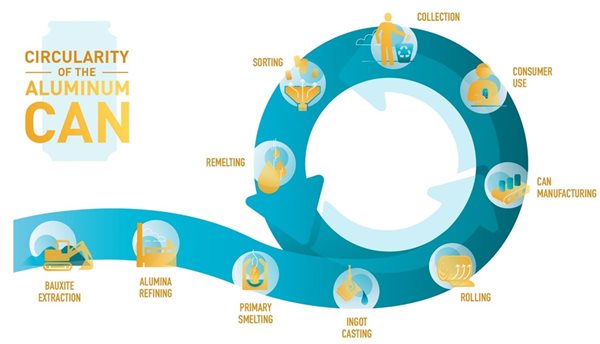

The value chain map below simplifies the metal packaging product life cycle and shows the significant impact areas. By knowing where these "hot spots" are, we can manage improvements more effectively.

LIFE CYCLE THINKING

While the environmental and social impacts of our operations are relevant, those of our supply chain are significantly larger. For example, manufacturing makes up approximately one-fourth of an aluminum beverage can's overall energy consumption throughout its life. Most energy consumption and associated greenhouse gas emissions occur during metal production, which our suppliers continue to make more efficient. Primary aluminum produced in Europe generated 21% fewer GHG emissions per ton produced in 2015 compared to 2010. The rolling-mill process also became 25% less carbon intensive during that same period. In North America, the carbon footprint of primary aluminum production was reduced by 37% per ton of aluminum between 1995 and 2010 -- with 75% of the electricity required for aluminum production coming from hydropower.

Life cycle thinking also means that packaging must always be considered in conjunction with the product it protects. Though packaging is not the only answer to the fundamental problem of food loss and waste, it is one part of a multifaceted solution. Metal packaging, in particular, prevents physical damage, protects the contents from the effects of oxygen and contaminants and maintains the nutritional value.

LATEST COMPARATIVE LCA UNDERLINES ALUMINUM CAN OPPORTUNITIES

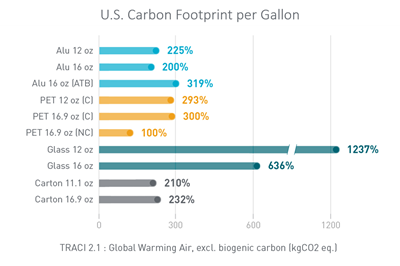

Life cycle assessment (LCA) is a valuable tool to track the carbon footprint of our products. In 2020, we published a peer-reviewed comparative LCA for aluminum beverage cans, PET and glass bottles as well as beverage cartons in Brazil, Europe and the United States. Among other findings, the study revealed that recycling is a key factor when it comes to the sustainability profile of all substrates.

To the right is a representative example for the LCA analysis of the U.S. Here, the LCA found that with today's actual recycling rates and recycled content, aluminum cans have a lower carbon footprint compared with glass bottles and PET bottles for carbonated beverages. This LCA also covered various sensitivity analysis and scenarios. For example, it shows that beverage cans have the highest carbon footprint variability when recycling rates, recycled content, and container weights are changed. Therefore, the cans' environmental impacts will benefit more than other substrates from increasing recycling rates, higher recycled content and lower container weights.

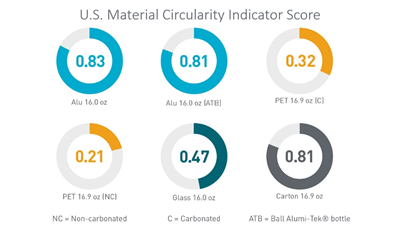

To move from linear to circular thinking, this study also applied the Material Circularity Indicator (MCI) methodology developed by the Ellen MacArthur Foundation. Related scores allow interested parties to understand to what extent different packaging options are a good fit for the circular economy. MCI scores range from 0.1, a linear product, to 1, a perfectly circular product. In all three regions, aluminum cans achieve the best material circularity scores of any single-use packaging option. Despite the fact that beverage cartons are challenging to recycle, the MCI methodology considers paperboard from sustainable sources as fully circular. The study results underline that by increasing efficiencies in our own operations and within our supply chain, switching our electricity use to renewable energy, and-- most importantly-- working with our customers, suppliers and other partners to increase recycling rates, the environmental profile of aluminum cans can be further enhanced, making cans a low carbon and circular package of choice.

The full LCA report, regional summaries and additional information about the LCA can be found here.